We are Vision,

a trailblazing Digital Neo Non-Banking Exchange platform

geared to streamline and revolutionize the way financial services are delivered and consumed in the digital era.

Our Platform is designed to serve

Various service providers such as NBFCs, Banks, Business Correspondences, Fintechs, Insurance Service Providers, Rating Agencies, Collection Agencies, KYC Providers, Credit-Bureau Agencies, AA Platform, LOS/LMS Providers, Marketing Agencies, VC & PE Firms, and Investment Bankers etc.

(Demand Side)

We provide a secure and seamless platform

Our best-in-class technology solution

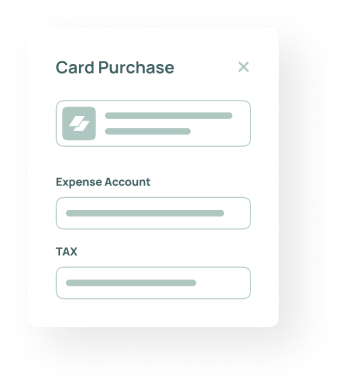

Accounting and payment software that handles it all.

- The data for each service provider listed on Vision can

- be utilized by Lenders for making

- hese credit decisions. We encourage NBFCs t

- Our product uses blockchain technology to build a trustless system

-

- This is important due to opaqueness in the ecosystem

- Use of blockchain technology will ensure that data is immutable, and parties can trust the platform

- Platform uses cutting edge Generative AI technology for fraud prevention, user behavior forecasting, predicting likelihood of deal success etc.

- The product would have an easy plug and play integration solution for all stakeholders such as MFIs, NBFCs etc. to easily connect to the ecosystem

-

- This would ensure that relevant stakeholders are able to share and view data in real time to reduce TAT

- The product has a robust rating system to objectively rate the stakeholders on multiple parameters such as integration TAT, commercials, credit policies etc. which is a ”first-of-its-kind”

Executed

Onboarded-

Value Closed

Deal Closed

closed

Advisory

“Your Success is our Vision.”

Works with all major US banks

Market Potential

With a breakdown of banks holding $1,585 billion, MFIs $40 billion, NBFCs $512 billion, and digital platforms with $270 billion, the potential for innovative financial services is vast.

Our platform is positioned to tap into this market, bridging service providers and users, and streamlining processes.

Evergreen is trusted by the best in the business.

Evergreen has saved me so much time on tax calculations. And it gives me reliable projections.

The UI is so intuitive that anyone can use it, without any knowledge on the system.

Allows you to erform reconciliations with your bank account in just a click!

Helps me keep a clean, organized ledger that I can access anywhere. Perfect for my organization.

Doing finance and budgeting right.

Most finance and accounting platforms work against you, than for you. They’re too complicated to use on a daily basis for all your requirements and end up consuming more time than they promise saving. Shift to the finance software that actually does what it claims.

I love the financial reports. The tool automatically organizes all data and gives us clarity on spend.